Current Corporate DAO Governance from a YGG Perspective

By Tiny Hand, 2022.1.6

Preface

The emergence of DAOs has begun to encourage a new type of autonomous organization design, making possible effective governance mediated by tokens and operating autonomously. And the shift from existing corporatism to DAO governance will require more experimentation and exploration.

YGG, currently the largest chain tour union in the crypto space, began to expand its territory outward in the form of a subDAO, and the company began to assume the functions of a master DAO while decentralizing its union functions.

YGG's strength in DAO exploration lies in its large user base (chain game players) and hierarchical organization (company structure), which fits well with the situation of most companies and is therefore a practical reference for the current "company-DAO" transformation.

This paper provides an in-depth analysis of the current organizational management of YGG, infers the process of establishing subDAO, and analyzes the relationship between YGG and subDAO in terms of functions, management, assets, and tokens, and discusses possible problems to be encountered in the future.

Catalog

- How to create a subDAO

- DAO, financial rights, management rights

- The relationship between subDAO and main DAO

- Settlement of fund flow in the form of DAO

- Questions and Reflections

- Conclusions

1. How to create a subDAO

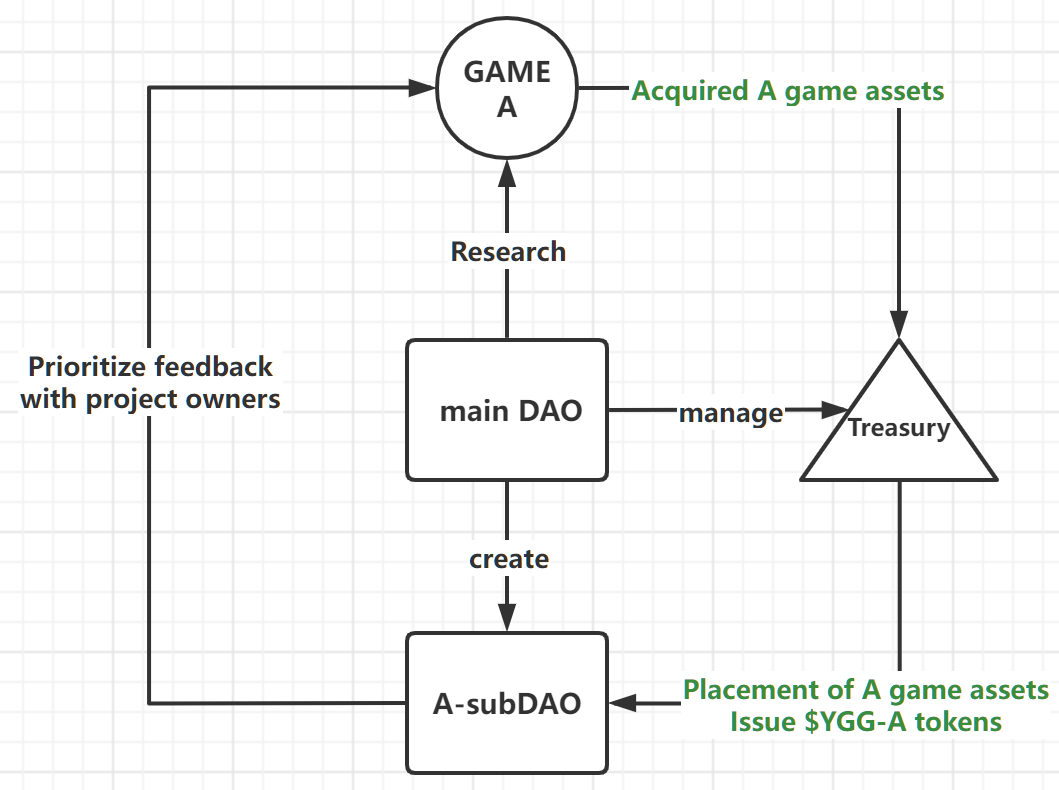

Path reduction of the process of creating a subDAO for YGG.

1. The research team of the main DAO researches a chain game project, which we call Game A.

2. After the research, decided to purchase a large amount of A game assets, assets in the form of NFT was transferred into the wallet of YGG treasury.

3. YGG Master DAO will establish an A-subDAO organization and appoint management personnel.

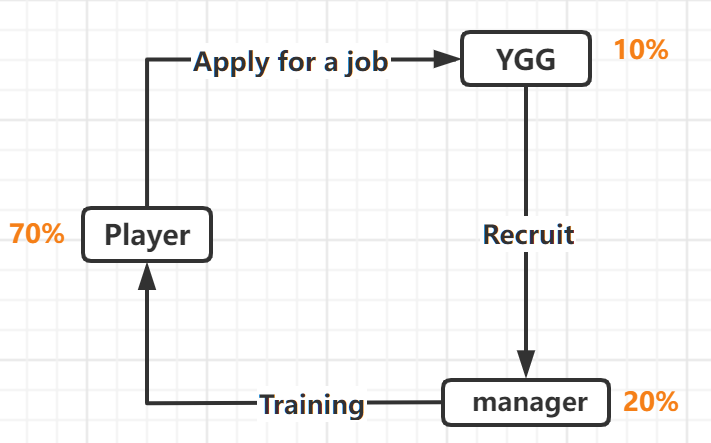

Participant Flow Chart

4. YGG treasury decentralizes A-subDAO with the purchased A-game assets.This transfer operation requires multiple signatures (CEO of the main DAO, CEO of the A-subDAO, and other management) for confirmation.

5. YGG main DAO issue tokens named $YGG-A, which are downgraded to A-subDAO by percentage.At the same time the main DAO treasury will retain a portion of the $YGG-A for governance rights.

6. A-subDAO will raise a new round of financing with a mix of YGG's original investors and new institutions.

7.After that, A-subDAO will refer to the main DAO in terms of management and token allocation.

2. DAO, financial rights, management rights

Insert a concept of "decentralization": refers to the process of decentralization of the main DAO, this process is a stage that all DAO organizations will go through, and for the company is currently unable to truly decentralize the control of property, the larger the share, the greater the weight of decision-making, which is also reflected in the current YGG:.

In the right to manage the national treasury

1. Before decentralization: the treasury was managed by the founding team, and the percentage of funds originally accounted for by the founding team plus the money from the treasury made the founding team have absolute influence.

2.After decentralization: the DAO is managed by the token holders of the organization, while currently the token holders can only participate in governance by making proposals for the main areas, namely: technology, products, projects, token allocation and governance structure.

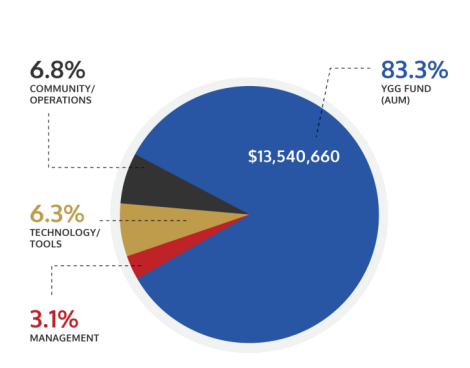

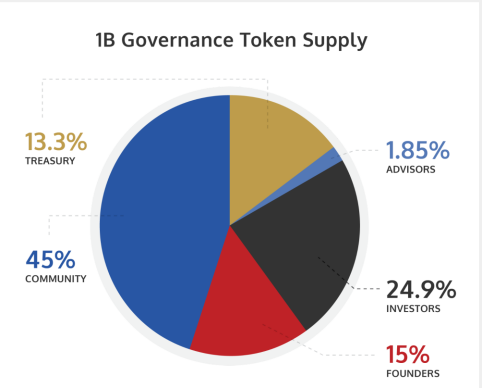

Funds are allocated as follows

|

National Treasury 13.3% |

There is no lock-up period or exercise condition. |

|

Founding Regents 15% |

2 year lock-up period. After that, linear for 3 years. |

|

Consultant 2.0% |

1 year lock-up period. |

|

Investors 24.9% |

The seed investor releases 20% of its allocation at launch. 80% of the token allocation will be subject to a 1-year lock-up period. Will vest linearly for 1 year after the lock-up period. |

|

45% community allocation |

None |

In terms of the evolution of the management organization.

Divided into three stages

1. Early Days: The Founding Nucleus Pilots and the earliest participants.

2. Mid-term: early stage investors, asset owners and participants comprise.

3. Later: YGG Token Holders

For a long time management has been more dependent on the leading role of the team, and there are many parties involved, how to achieve the late governance fully allocated to the token holders as YGG said? It is impossible to achieve this by relying on the existing token governance mechanism alone.

As you can see, the evolution of the management form of the main DAO also affects the management form of the subDAO. Nowadays, subDAO starts to assume the functions of the original main DAO and inherits the form of YGG main DAO in the evolution of management, e.g.YGGSEA.

3. The relationship between subDAO and main DAO

Functionally

While master DAOs are now more oriented towards institutions responsible for asset management and investment research, subDAOs tend to focus on one game or one asset under management. For example, YGGLOK focuses on LOK, a game. At the same time, subDAO focuses more on professional people doing professional work, and favors localization and sub-regionalization in the selection of management and operation staff, e.g. YGGSEA focuses on P2E economy in Southeast Asia region.

In the management

YGG's investment in subDAO is more based on the trust between the teams. Take YGGSEA as an example, the actual promoter of YGGSEA is actually one of the YGG seed investors, and now YGG also prefers to bundle interests more with management, so when establishing a subDAO, YGG will directly make the assignment of the CEO of the subDAO, which is also the most effective and efficient way to delegate management.

In terms of asset division.

1. The asset management of each is separate, for example, YGGSEA's funds will be reinvested with their own assets, and currently in the commission sharing mechanism YGGSEA is more demanding than YGG and will take more percentage, so subDAO has the right to manage their own assets and allocation formulation.

2. In the early days of the subDAO's establishment, YGG also transferred assets to the subDAO by way of funding, such as YGGSEA through a multi-signature wallet (at least three of the five holders must approve any movement of funds), and in YGGLOK's program, YGG transferred purchased game assets to YGGLOK's subDAO wallet through a multi-signature wallet.

From the token mechanism.

1. subDAO will issue its own tokens, and both main DAO and subDAO will cross hold tokens from each other, and allocate the token ratio according to the primary and secondary (e.g., the main DAO treasury owns 56% of YGGLOK's total tokens, and the specific ratio of other subDAOs is not yet known), and YGG will further participate in subDAO governance decisions through the tokens held by subDAOs.

2. According to YGGSEA's announcement, the sub-tokens and main tokens can be directly converted in the secondary market

3.The value of the main DAO token $YGG will be composed of the value of the tokens of each subDAO on a percentage basis.

![]()

(Note: The formula refers to the YGG white paper)

4. In addition, YGG will give support when the early subDAO tokens are released, for example, YGG and YGGSEA trading pairs may be given priority, and YGGSEA will also target YGG users for airdrop to attract traffic.

4. Settlement of fund flow in the form of DAO

Business Path

Business Flow Chart

1.Players apply for part-time jobs, community managers are responsible for pulling people and training, and YGG provides lending of game assets (NFT).

2. The currency of settlement and draw between personnel is the tokens obtained from playing gold in the game.

For example:if you play gold Axie will use the actual SLP received for the settlement of the parties' personnel.

3. The specific funding split is: 70% for players, 20% for community managers and 10% for YGG.

4. The whole process is automatically allocated through smart contracts to form a self-running capital chain.

5. In the form of DAO participation, the main experience path for users is: participating in the scholarship program, playing gold to get the corresponding game token rewards, and holding token users to participate in governance voting.

Investment Path

The main DAO's investment in subDAO is generally made in the form of stablecoin, and transfers are made through multi-signature wallets, with the amount and frequency decided by management. In this regard, we can see that YGG is still partial to the centralized form in investment decision, and YGG also reflects the decision result and investment behavior on the stablecoin transfer of the wallet.

5. Questions and Reflections

- Token relationship between main DAO and subDAO?

In terms of token linkage, the main DAO token will be affected by the combined influence of each subDAO token, but it is impossible to tell the specific impact between them, e.g., when the subDAO token has a negative impact on the main DAO token in the market, will the main DAO make constraints on the subDAO to avoid market risk? Or is it self-adaptive through smart contracts? These are all hidden dangers that affect the value of the token ecosystem.

- the current distribution of DAO governance weights?

In the current YGG and the built subDAO, we see that the share of governance in the form of DAO is weak. For example, in the core decision, it still depends on the internal discussion of the founding team, and finally the investment behavior in the form of stable coins and multi-signature wallets. Another example is that in the core team of subDAO, YGG still chooses to send its own people as the management, so as to carry out the bundling of long-term interests. Blockchain token has financial and governance attributes, unlike company equity, blockchain token is more free circulation, which also means that management power is more decentralized, so how can YGG further increase the weight of DAO under the current management?

- A purer incentive design?

We know that the governance of DAO should not only form a consensus, but also give certain incentives to each participant in the governance. In the former case, YGG has already established a brand effect, and in the latter case, incentive paths have been designed for each participant in the business stream, for example, players can not only play gold to get income, but also simply hold YGG tokens to add value; managers can get the incentive of governance tokens by participating in the initial community building, and can also get periodic compensation of stable coin settlement later. Specifically, these designs are a mix of "traditional input-output distribution" and "new DAO governance distribution", and the design of the later incentive paths needs more code-oriented and automated improvements to complete the transformation.

- Efficiency tools: DAO VS Company?

Nowadays, the efficient operation of a company often works with a variety of efficiency tools, if you work in a company, the office tools are office, communication tools are nails, and some internal collaborative software, etc. Nowadays, DAO mainly communicates in the form of Discord, with the collaborative tools are still not sound, and the efficiency of governance depends entirely on the self-driven community members, so how should DAO solve the organizational collaboration efficiency?

Conclusions

When the YGG main DAO undergoes a transformation, it is neither a community-based foundation like the Ether Foundation, nor an independent foundation that favors individuals and families, but more akin to a corporate foundation, where the funds are managed and used primarily for investment purposes.

No matter the ideal state of democracy mentioned by the government or the blueprint written by the company in the white paper, there is no doubt that the bottom-up DAO governance is more important, but from the analysis of the functions, management, investment and assets of YGGDAO in the previous article, "top-down" is still the main form. Although DAO will become the main organizational structure in the crypto field in the future, from the perspective of management efficiency and power, there will be a parallel state of corporate system and DAO for a long time.

Perhaps we can expect that as YGG decentralizes operations, decentralizes management, and decentralizes assets, different subDAOs might diverge into different forms of governance.