With the cycle shift, is there a future for the pass-through economy?

By TT, 2019/8/7, Translated with www.DeepL.com

Recently, Tony Tao, the founder of X-Order, was invited by Chain Node and Babbitt to give a talk titled "Is There a Future for the Pass-Through Economy? in which Tony gave a speech on the topic of "Is there a future for the pass-through economy?

In his speech, Tony reviewed the market experience in the last six months and compared it with the perceptions formed in the last cycle.

The following is a compilation of the speech content.

The market in the last cycle

During the last bitcoin cycle (2014-2018), a lot of things emerged and many changes occurred throughout the pass-through market. During this process, there were a few ideas that slowly implanted themselves in my head.

First, the growth of blockchain equals the rise of bitcoin.

Second, the pass-through economy is more important than bitcoin. This was especially evident in the last cycle. This is mainly reflected in the fact that the whole market is led by ethereum, not by bitcoin.

Third, Bitcoin is just the beginning of the blockchain revolution. Because everyone thinks that Bitcoin is the first application of blockchain technology, there will be all kinds of applications after that.

Fourth, the BTC Dominance Index (Bitcoin Dominance Index) will continue to decline. This value dropped from 90% in the last cycle to 40% and will still be declining at the end of 2018. So it was predicted at the time that the BTC Dominance Index would fall to 10% in this cycle.

Fifth, the market is full of Ponzi bubbles, but it will get better in the future.

This is the notion implanted in my mind in the last cycle: although the whole market is full of various black swan events, it becomes better and better.

Although 2018 is a bear market, I think it is still better than 2017 because the whole market becomes more and more rational.

The last six months market review

But in fact, looking at the development of the pass-through market in the past six months, one will find that the results are quite different from what I expected.

First, compared to the previous cycle, blockchain development is relatively lagging, or slow.

Second, Bitcoin is instead more popular than the pass-through economy. This is reflected in the price of the currency. When we discuss the pass-through economy, we can't get around bitcoin in the first place. Looking at the price of bitcoin, there are only a few coins in the market that have risen more than bitcoin in the past year.

Third, with the exception of Bitcoin and some coins issued by mainstream exchanges, the value of the rest of the pass-throughs is rarely recognized by people. This is also closely related to the last cycle. In the long run, we are more concerned about bitcoin or underlying with cash flow revenue, such as exchanges represented by BNB.

Fourth, the market is still full of Ponzi and money markets, even more so. Some of the ponzi nowadays have been able to do a certain underlying and easily go to tens of billions of dollars in a few months.

Fifth, the BTC Dominance Index keeps rising. This index has now reached 65%.

In the last cycle, since the emergence of various cottage coins, the Bitcoin Dominance Index was sliding down rapidly and took a long time to return to its original value.

However, in this year's cycle, the Bitcoin Dominance Index has easily gone back up to 60%, and even moved up again and again.

What went wrong?

So, back to the question earlier, what is the value of pass-throughs? Is there still a future?

This is a very serious topic. Because I'm sure you all came to this event with confidence in the future, and expectations.

In fact, for most blockchain practitioners, at the beginning of this year, they were already prepared that the bear market would last for at least a year.

But after the first half of the year, we found out: the bear market ended quickly, bitcoin price rose back, while other pass-throughs did not rise.

This stark contrast bothered me so much that in recent months I've been reflecting: what went wrong with the market? Or is it the feeling of most people in the blockchain industry that something is wrong?

We know - the market is always right, so it can only be us, the industry people, who have gone wrong.

But what went wrong? I think maybe we need to learn to reacquaint ourselves with the market - what's different from before?

Cycles: the pendulum of the economy

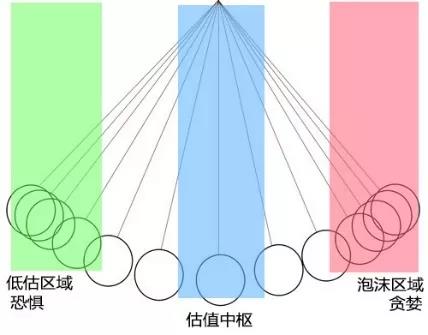

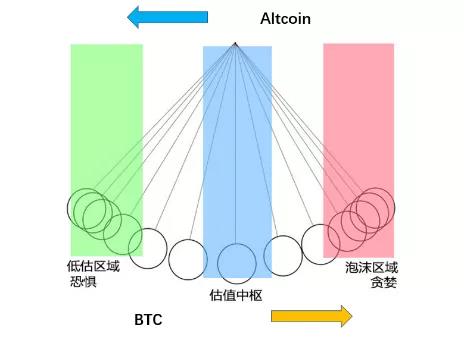

The above chart is a typical pendulum theory: the green zone on the left is in an undervalued, fearful state; the middle is a kind of pivot of value; and the right is a bubble.

We can imagine: the price of an underlying is in the market, swinging back and forth from left to right, rarely staying in the pivot area of value. And according to physics, we know that it is in this region that it oscillates the fastest.

Many people will use this chart to explain finance and economics, but the explanation will end with a key word called cycle.

Although everyone knows the cycle, I didn't care very much about it before, let alone think that the cycle will cause such obvious fluctuations to the market of this year's cryptocurrency. In fact, my biggest obsession this year comes from the cycle.

In order to be able to explain more reasonably what has happened in the last six months, let's step out of the cryptocurrency world and look at the pendulum of the global economy.

2019: Paradigm shift due to anxiety and unease

First of all, take a look at this screenshot, written by Zhu Min, who attended the 2019 Winter Davos Forum.

In this forum, Zhu Min, who has attended Davos many times, mentioned in his handwritten note that almost everyone present, for a change from the optimism of 2018, generally presented anxiety and unease.

Then, Ray Dalio, the creator of Bridgewater Fund, the world's most powerful financial industry KOL, said, "Let's pray for peace!" , which also conveys a sentiment to everyone - anxiety and uneasiness.

The Davos Forum, the world's top financial and economic forum, began the year by conveying a mood of unease to economists, heads of institutions, and even economic policy makers in the global economy and finance.

That uneasiness translated into a rise in bitcoin over the next six months.

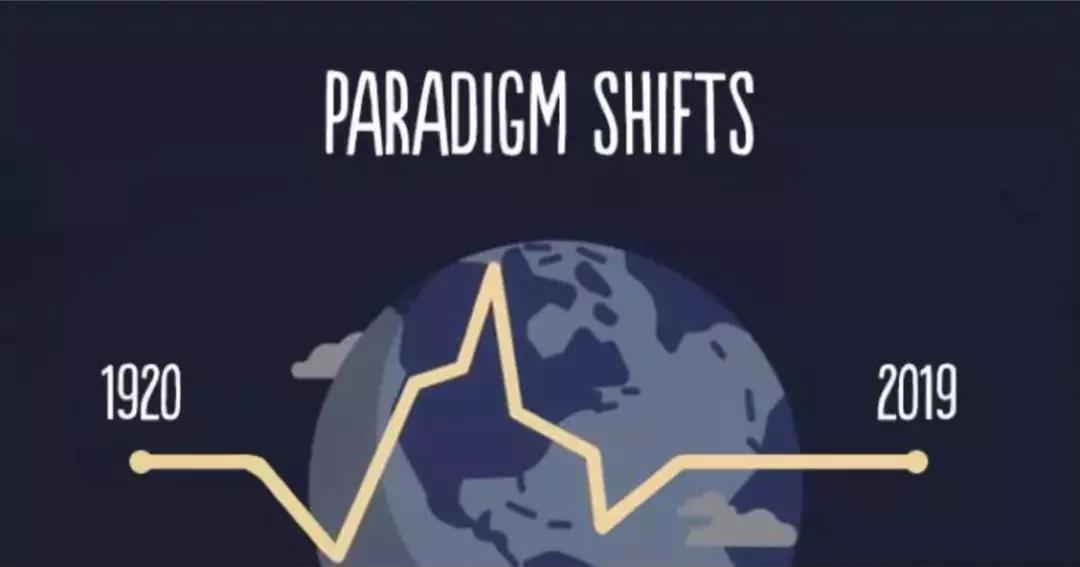

Just last month, Ray Dalio spoke out again, "Gold will be the top investment choice after the next paradigm switch."

In the investment process, if you are always looking at line investments, you will often be eliminated from the market during a paradigm switch. A prime example of a paradigm switch is Bitcoin breaking the $6,000 mark this year.

Almost all of us thought that $6,000 was a very strong resistance level that would be very difficult to break. But it eventually broke through, and the reason for that was the paradigm shift.

During this year's paradigm shift, we found that bitcoin is a very good and many people are going to grab the asset - as evidenced by the fact that some large institutions and even certain countries have started buying bitcoin this year.

So what does that mean for the next paradigm shift in top investment choices? It means: for institutional investors, they will probably pull out of equities as well as equity investments.

We all know that in a pendulum cycle, when the economy is doing well, people go into stocks, or some commodities like real estate. But in a bad economy, the first thing you might choose to do is hold cash.

If the economy is bad to a certain extent, when there is an economic crisis, political crisis, then people are not changing cash, but directly hoarding gold.

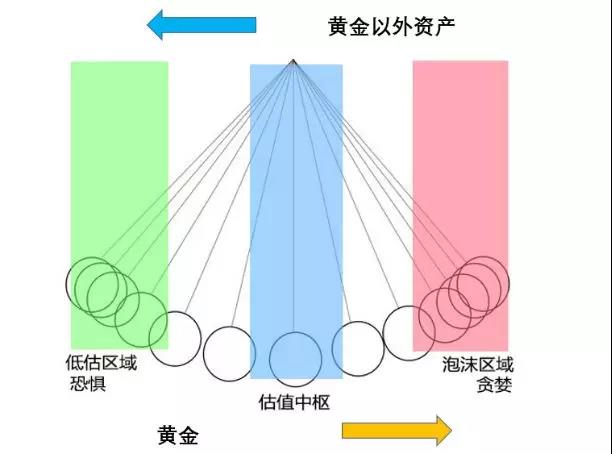

Now go back to this chart and you will see that in fact Ray Dalio is trying to tell us that gold is now swinging to the right, it is swinging to the right from a state that is ignored, even feared by everyone; while all assets other than gold, are going to the left.

Of course the pendulum will still swing back, but the question is when will it swing back again? Right now the whole market is clearly swinging to the right, which means that people's risk aversion is clearly still increasing.

Restless situation

There is a lot of news recently that can support a kind of judgment on the whole global economic and political situation, such as Huawei, China-US trade war, etc. By looking at the current situation, we will find that real estate and stocks are basically at the bottom of the market. Real estate has about 2% a year a rent; and stocks, the U.S. stocks now people are afraid to buy again.

Secondly, the economic situation in most mainstream countries is not good, and political turmoil is increasing. The situation in the United States is not optimistic, not to mention Europe.

These two days Japan is restricting the export of some materials to South Korea, and these materials are very important for the manufacture of semiconductors. Once the restrictions are issued, then South Korea is likely to collapse in a flash on top of the semiconductor, and another trade war will start.

The last one, is the rise of populism - explained in layman's terms as self-protection and refusal to cooperate with foreign countries. Britain's exit from the European Union has of course been said for many years, while other places such as the Middle East, Iran and Iraq, and some factors that we can not see ......

The most intuitive feeling we get from these things is that the political situation is moving in an increasingly conservative populist direction.

Survival or prosperity?

So, in this cycle, there is a very instinctive desire to hedge. Because the conflict will intensify if the situation continues to go on as it is.

Of course this is a relatively bad situation, but we all know that one of the strongest human ability is imagination. Many things do not have to wait until it really happens, once when you imagine that it is about to happen, you will choose to protect yourself.

When we see a variety of events in real life, are suggesting that we need to go to self-preservation, we will choose a way to avoid risk. And when people choose to hedge, what do they do?

This time most people's mindset is selfish, self-preservation, closed, live, clinging to the straws of life ......

You don't think I'm going to collaborate, I'm going to create a future thing, or how technology will change us in the future? It won't.

The only thing you think about at this point is that I want to survive.

Ray Dalio only talked about gold, not bitcoin, and it looks like he wasn't very bullish on bitcoin before.

But there's no denying that Bitcoin is another kind of digital gold, and that's becoming a consensus in more and more people's minds.

So why are the smaller coins not moving up in this cycle? What's behind the smaller coins?

In the last cycle, there was a constant stream of Ether, Defi, and other blockchain technologies that outlined the future for us. At the time, they represented a hype, a hope for people.

It is true that prosperity and hope is the mainstream of the whole world development, but it is also cyclical in nature. The trend now is - the pendulum is moving towards conservative risk aversion and it hasn't come to a head yet.

Bitcoin or small coins?

Let's look at the cryptocurrency cycle with a two-way view, and it's clearer at this point. In this cycle, Bitcoin is fulfilling a global hedge need, not a HYPE need.

While Bitcoin was the first application of blockchain technology, it no longer has much to do with technology. Now in everyone's eyes, bitcoin is a digital gold - a very conservative, just a lifeline that you want to go grab when you're in trouble.

And it's the folk hype that small coins meet. All of us here want to get rich off of small coins, but very few of us think about getting rich off of bitcoin because we would think that bitcoin might not be going up enough.

The reality tends to present a will of the majority of the world's population - i.e., a swing in the direction of safe-haven, rather than a swing in the direction of hype.

Ray Dalio tells us: gold to the right, other assets to the left. And in the last six months of cryptocurrency development, the various coins have shown that Bitcoin goes to the right and Altcoin goes to the left.

Altcoin represents the future and is hype; bitcoin represents conservatism and is risk aversion.

The Future of the Pass-Through Economy

Let's go back to the question: Is there a future for the pass-through economy?

Before we give an answer, let's think about this: what is a healthy token market? Is it full of hype? Is it one where prices are skyrocketing? While people like both, is it a healthy market?

With a little thought, we can conclude that a market with soaring prices and full of hype is not healthy. But I think there is a future for the pass-through economy, and the key to that is its cost.

Let's take a look at the cost and threshold for listing on Nasdaq, here's a graph cut from the top of Knowledge.

These are the two bids: one bid for an IPO is $25 million and the other bid to raise $500 million. The penultimate line shows the fees, and the bottom line is the percentage, which are 17% and 13%, respectively, and the fees reach $4.3 million and more than $6 million, which is the cost of one of its listed IPOs.

And our recent hot science and technology board, the threshold is one billion to 10 billion, that is, one billion is a minimum threshold for its listing. So how much does it cost? About 30 million to 100 million.

In other words, although you can make a lot of money by listing a KCI marker, you have to pay so much money first to do so.

But what about in the cryptocurrency world? Take Binance Dex as an example, the listing fee is around $100,000, which is a baseline inside the token industry. It features a much lower cost than the Coin Board just now.

When we went to look at the Coin Board, it was introduced that it would be more efficient and cheaper than the NASDAQ and various exchanges.

But even so, even if the KCI board wants to lower the threshold, regardless of revenue details and market capitalization, it has no way to bring its revenue or listing fees down to the scale of the coin world.

Based on this, we can still have faith in the pass-through economy because it has a very low cost. All economic activities have a cost, and since it is a market activity, we can compare their costs.

Obviously, the cost of passwords is lower, and although the quality of the bids in the market is poorer, that won't stop better bids from popping up in the future.

Just like when Netflix first appeared, we all thought that it was impossible to grow with such poor quality videos in it, because what people need is high quality videos.

But now it turns out that Netflix is doing very well. The low quality videos that were criticized by people in the initial stage are not mentioned by anyone anymore.

So in the initial stage of development, what is more important is the cost, the threshold must be low, this is the way to survive in the Internet era.

This is the end of today's sharing, thank you.