Interest rate - how does the price of legal currency affect our investment and decision-making

By Wang Runyu ,2020-03-24,Translated with www.DeepL.com

This time, in addition to the epidemic-related news, another topic that dominated the financial headlines around the world was interest rates.

Abroad, there was the Federal Reserve's March 10 release of an over-expected interest rate cut that disrupted the movement of global financial markets. Domestically, it was the official opening of the policy of switching from stock rate loans to LPR.

The former is the first time since the financial crisis in 2008 to cut interest rates beyond expectations, and the latter involves the people's mortgage, which practically affects everyone's pocketbook.

This also triggered a lot of interest rate concerns and discussions, no less than the money shortage in 2013 when people were discussing money fund rates. At that time, most people took their savings out of the bank and deposited them in the more convenient and higher interest rate balance funds.

In this article, we will start from the origin and definition of interest rate, explain the operation principle of various economic activities in the business society, and then combine it with the evolution of interest rate in China in recent years in order to find out the future direction of the market, and also help everyone to have a more in-depth understanding of interest rate.

We hope that this sharing will not only guide our investment and financial management, but also raise everyone's awareness, stimulate independent thinking, reduce panic and excitement, and thus make more correct choices.

Note that the purpose of this article is mainly popular science. Since the author has no experience in working in the fixed income departments of large banks and funds or in scientific research in university economics disciplines, there is no guidance in these two fields, and the interpretation of various interest rate products and the analysis of trading methods will not appear in this article.

1. The "table" and "inside" of interest rates

Focus on the rise and fall of interest rates, as well as the central bank to raise and lower interest rates, only its "table". Only by understanding the "inside" of interest rates can we rationalize the impact of interest rate market changes on the whole economy and thus improve the accuracy of market judgments, instead of getting lost in the financial news noise and the haphazard interpretations of the self-published media.

The author will start from these three issues, like peeling an onion, to analyze the nature of interest rates.

a. Why do we need interest rates?

b. What does the level of interest rates represent?

c. How do interest rates explain all economic phenomena?

a. Why do we need interest rates?

The interest rate is a price of fiat money, in addition to which there are two other prices: the exchange rate and the price of goods.

The price of goods, known as the internal value of money, is the commodity property that money has, that is, the price of money relative to other goods, such as how many pounds of grain it can be exchanged for. Historically, before there was fiat money, there were all kinds of things that people used as currency and coins, such as precious metals like gold, silver and copper, and wear-resistant items like shells and stones.

And the price of a country's currency in relation to a different currency of another country is the exchange rate, also known as the external value of the currency.

These two prices are similar to the usual transactions when buying groceries in the vegetable market or shopping in the supermarket, which are well understood by ordinary people.

And interest rate, as the financial value of money, also known as the time value of money, although the concept is abstract and difficult for ordinary people to understand, but it does not prevent it from being the cornerstone of all asset prices.

Business activities related to interest rates, such as lending and discounting of bills, appeared early in the private sector, but it was the issuance and circulation of treasury bonds that brought the combination of the two to prominence.

In 1694, thousands of shareholders raised £1.2 million to take a stake in the Bank of England and lent £1.2 million to the government, and received the right to issue bank notes in the same amount. Since this £1.2 million was both the entire capital of the Bank of England and a debt of the contributing shareholders to the royal government, it was equivalent to the national debt issued by the crown through the Bank of England. In other words, this cooperation enabled the Bank of England to exercise the function of market-making of the government bonds in disguise.

(Based on the link "The History of British Money: The Birth of Paper Money and the Great Unification": https://zhuanlan.zhihu.com/p/68384107)

Bank of England

The circulation of the national debt had the effect of reusing assets. The government borrowed 1.2 million pounds of gold coins, and through the purchase of arms, recruitment of soldiers, and royal spending, this money flowed back to the people, while the rich, although their money was borrowed, could offset the discount on the national debt and exchange it for gold coins, and their own businesses and investments were not affected.

Asset reuse was also reflected in the later municipal bonds, railroad bonds, and stocks. By this time, the rich were more willing to invest and hold interest-bearing and dividend-paying assets, securities, and deposits. Large amounts of gold and paper money flowed to laborers, who began spending with increased real income, which in turn stimulated more trade and production, and factories and businesses hired more people.

Thus the discounting of treasury bonds and securities, the valuation of investments, the matching of loans, and other modern financial operations involving intertemporal calculations cannot be separated from and linked together by interest rates.

Human society, transformed by modern finance, has also come to realize that the essence of money is an incentive to organize production. It does not matter whether it is gold, silver, copper or other objects, as long as the money sent out correctly stimulates production and innovation, hyperinflation and vicious devaluation are difficult to occur, and the interest rate of fiat money thus becomes a more important price than the exchange rate and prices.

b. What does the level of interest rates represent?

For businesses, high or low interest rates mean high or low borrowing costs. Except for the virtual economy such as the Internet, industrial operations rely on borrowing and debt issuance for both short-term and long-term funding because of inventory turnover, capital account periods, and the tax-deductible effect of long-term debt that does not affect control.

For workers without fixed assets, high or low interest rates mean interest income from bank deposits and wealth management. However, if society is affected by high interest rate to the normal operation of the entity, enterprises downsize and workers lose their jobs, in this case, the negative impact of decreasing income of workers will be greater than the impact of increasing interest income from financial management.

As for workers with fixed assets, or how interest rates affect changes in asset prices, especially stocks and homes, which are more familiar in the country, the details will be analyzed later in this paper.

Here is some background to help you better understand the role that interest rates play in an economy.

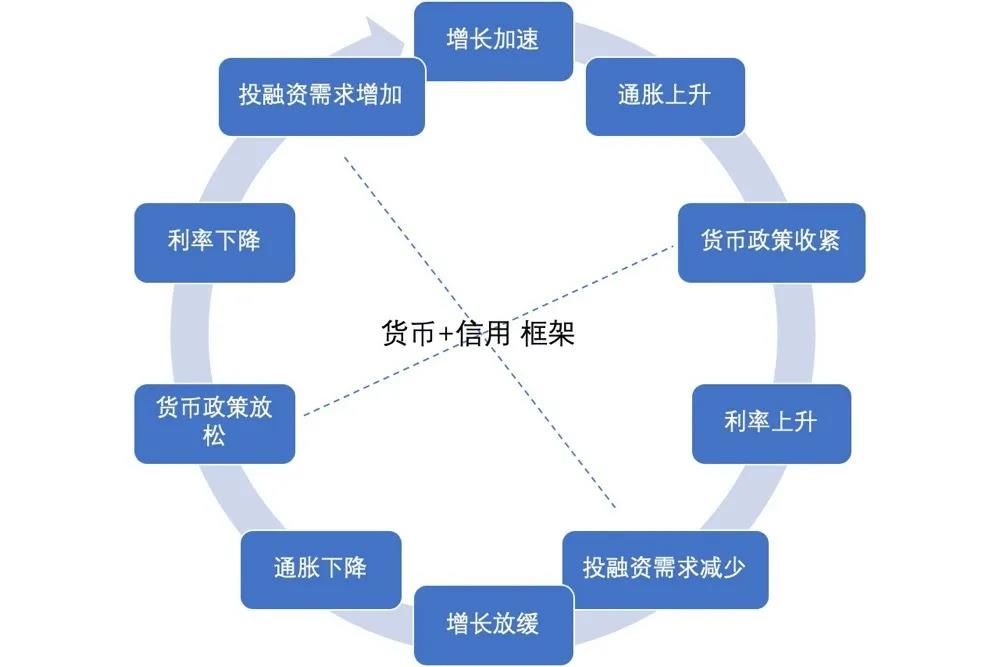

- the development of the economy must need the rise of enterprise credit, investment and financing to support, observe the data is generally M2, social financing increment.

- the government promotes enterprises to actually take the new borrowed money to production, called broad credit. The central bank, as an independent department, will adjust interest rates to influence the loosening and tightening of the currency, lowering interest rates for relaxation, also known as broad money.

- broad money will be converted into broad credit through certain conduction, conduction, if not smooth, will produce funds idle, de-realization to deficiency.

- Broad credit does not necessarily require broad money, and may be promoted by technological advances, deregulation, tax cuts, foreign capital inflows, etc.

c. How do interest rates explain all economic phenomena?

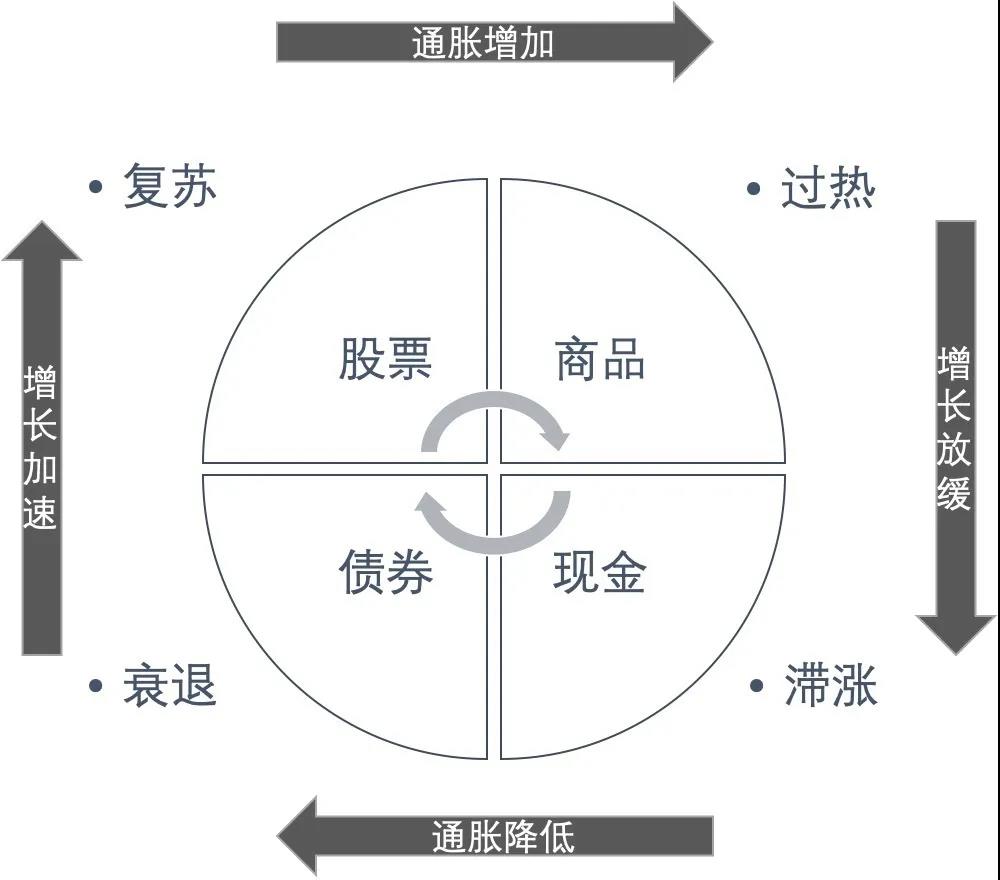

A more common theory that explains economic cycles and asset performance is the Merrill Lynch clock.

Merrill Lynch clock to economic indicators and inflation indicators, the economic cycle is divided into: depression, recovery, overheating, stagflation, corresponding to the current investment products should be, bonds, stocks, commodities, cash.

But Merrill Lynch clock it is only an analytical indicator, framework, similar to the thermometer, can only tell the current position of the market, can not determine the turn, deviation, so in the real guidance of investment behavior is not very useful.

But we can start with interest rates and dismantle the Merrill Lynch clock to come up with a picture that is more logical and more in line with the behavior of all parties in the market.

First, the signal that the economy is entering a recession is corporate investment and financing, which is falling, i.e. tight credit. This leads to a decline in growth, a decline in income, a decline in demand and consumption, followed by a decline in inflation, so the central bank begins to regulate and lower interest rates, i.e., easy money. During this period, money is invested more in bonds that benefit from lower interest rates.

Second, interest rates fall, stimulating companies to start lending and get on capacity, corporate investment and financing starts to rise, i.e., easy credit, and the economy starts to reverse and recover. During this period, more money is invested in commodities that benefit from the recovery in investment and financing.

Again, as the economy recovers, incomes increase, demand and consumption rise, bringing inflation, and the economy begins to overheat, so the central bank begins to regulate and raise interest rates, i.e. tight money. During this period, money is invested more in stocks that benefit from inflation.

Finally, as interest rates rose, although not yet transmitted to residents' income and consumption, inflation did not fall, but corporate investment and financing began to decline, i.e. tight credit, economic growth was weak and entered the stagflationary phase. During this period, the capital more to adopt the "cash is king" strategy, into the next round.

This analytical framework highlights the transmission of interest rates to social investment and financing, i.e., changes in interest rates guide firms' investment, financing and production. Therefore, there are times when the framework fails, i.e., when major international events occur that affect the global economy.

For example, during the oil crisis and the Vietnam War in the 1970s, because of the sudden rise in the cost of living and production as well as the post-war baby boomers' adulthood, the past spending on military and welfare in the United States did not bring about a timely increase in corporate efficiency, people scrimped and saved, but their incomes did not improve, the demand for goods in society as a whole fell to a limited extent, and inflation did not decrease. This also led to the central bank did not dare to significantly reduce interest rates to avoid further stimulation of inflation, high interest rates and some enterprises bankruptcy brought unemployment, economic growth continued to decline.

In that era, the developed countries were caught in a long-term stagflationary spiral, and it was only by relying on technological advances in the 1980s, Reagan's tax cuts, encouragement of privatization and restructuring, and other measures to increase social production that inflation was suppressed.

Another example occurred in the 1990s. At that time, with the end of the Cold War, technological advances and the expansion of globalization, the United States entered a period of high economic growth and low inflation. This was manifested in the economy by increased corporate investment and financing, increased employment and income, but no significant increase in inflation because production increased more rapidly. As a result, the central bank could still maintain a policy of low interest rates. In turn, low interest rates stimulated businesses to increase spending and production, which in turn made people's income increase. This economic boom lasted until the Southeast Asian financial crisis and the Russian debt crisis.

In short, the only things that can break the law of interest rates are technological progress and politics, but the law of interest rates will not disappear, it is just postponed.

Next, we will use interest rates to review the last decade in China.

2. A review of interest rates in China over the last 10 years.

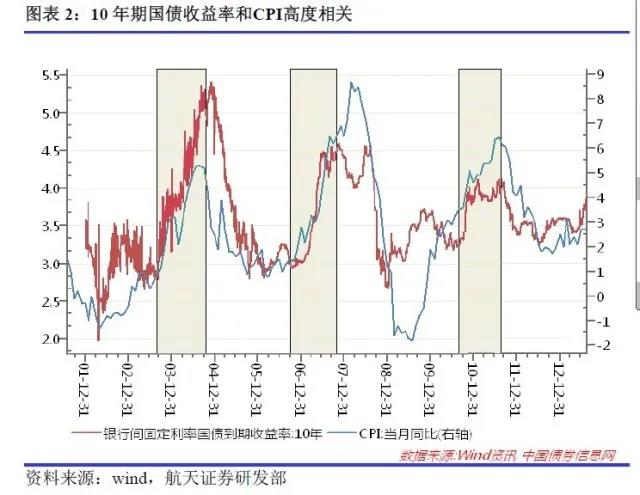

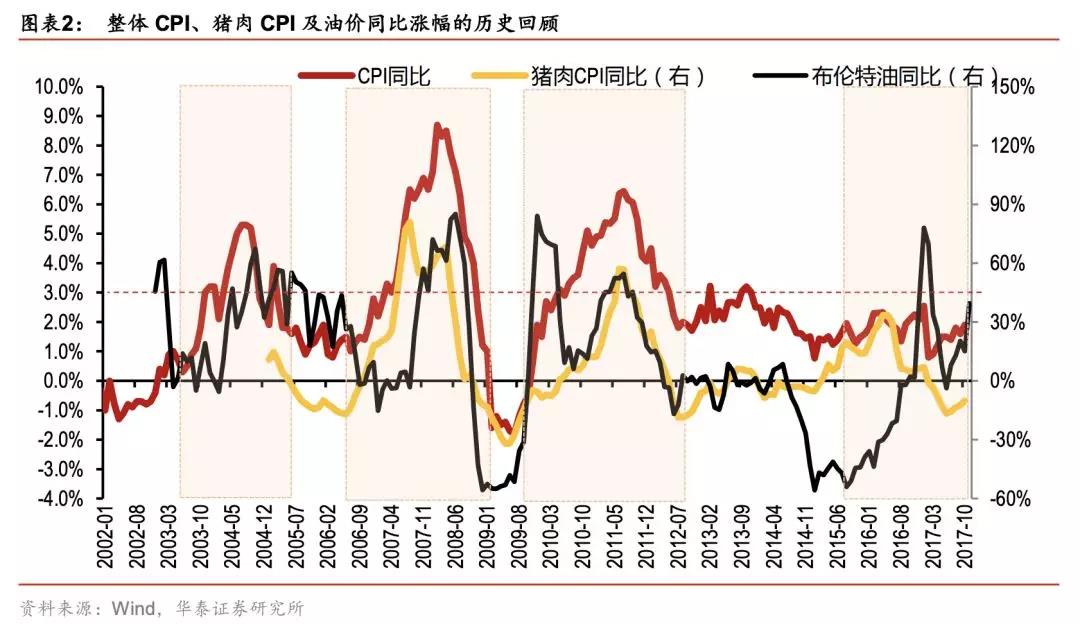

Prior to 2008, the market was more concerned with the impact of CPI on interest rates, i.e. inflation on the consumer side.

An important component of the CPI was the price of pork. At that time, the pork industry was dominated by free-range farming, showing a trend of chasing up and down.

- The economy became better, demand increased, pig prices rose, and farmers increased pork production while suppressing pens to keep pigs out, further pushing up prices and pushing up the CPI.

- Then the central bank raises interest rates, depressing demand, while the high price of pork reduces market demand.

- Demand drops, pig prices fall all the way down, farmers start to desperately let pigs out again to reduce losses as much as possible, but the supply of pork increases, further causing prices to fall, making the CPI fall.

- When the central bank cuts interest rates, demand picks up and a new cycle starts again.

At this stage, CPI well reflected the warm and cold market demand. Later, because of the gradual scale and specialization of pig farming and the changing economic situation, which required the central bank's policy to match the new domestic growth model, CPI no longer became a leading indicator of the direction of interest rate changes.

Another characteristic of China before '08 was that the differences between different places were gradually widened. The coast benefited from the foreign investment and foreign trade dividend after joining the WTO and developed rapidly; some energy cities and political centers in the north also enjoyed growth dividends; the remaining regions developed slowly, economic activities were simple, and people still mainly wanted to live well, which verified that meat prices were the basic contradiction in the mainland at that time.

After the financial crisis in 2008, overseas orders and demand plummeted, and some foreign investors went home to put out the fire. China needed to change its simple "China production + world consumption" model, and fiscal and monetary policies started to work together to better serve its own economic growth, i.e., the "four trillion" policy, which on the one hand was to boost the demand for infrastructure in places that had not enjoyed economic growth in the past, so that they could integrate into the national market as soon as possible. On the one hand, the "four trillion" policy is to drive localities that have not enjoyed economic growth in the past through infrastructure demand, so that they can integrate into the national market as soon as possible, and on the other hand, to meet infrastructure demand and future domestic demand, lower interest rates, and support faltering and surplus industrial enterprises to tide them over and assist in their transformation.

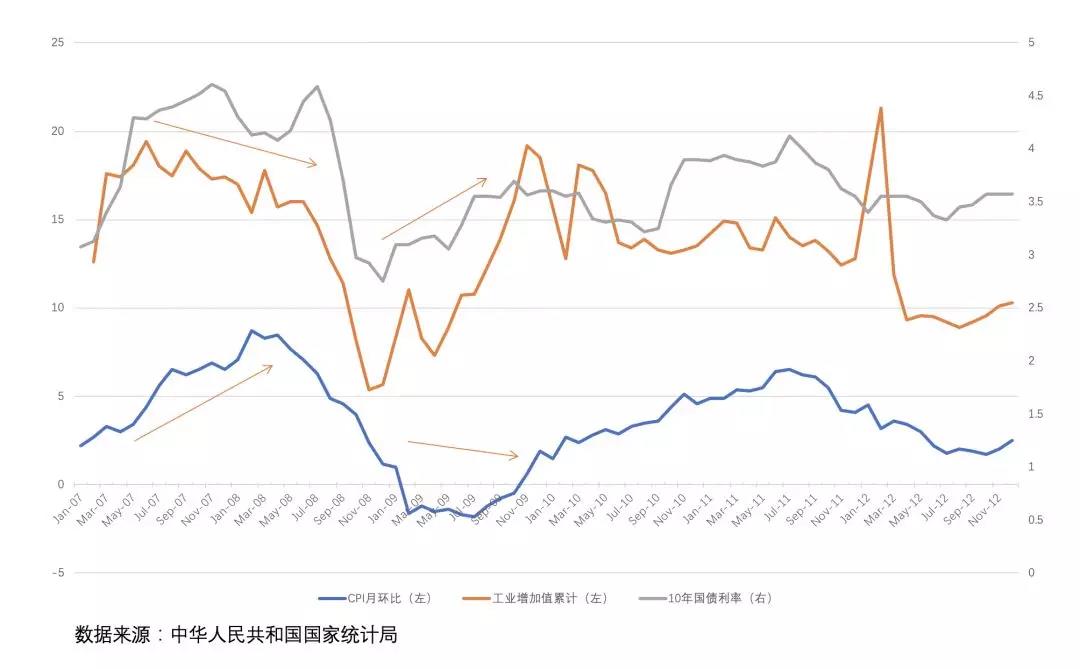

At this stage, the market judged the factors influencing interest rates from the past single CPI, expanded into nominal GDP, nominal GDP for economic growth + inflation, industrial growth accounted for the bulk of economic growth at this stage, industrial goods inflation, i.e. PPI, accounted for the bulk of inflation, so it can also be said that at this stage the market considered industrial growth + PPI, influenced interest rates.

By 2013, the situation had changed and there was a divergence as industrial prices, industrial growth, and nominal GDP growth fell on one side, while on the other side, interest rates were moving up and loan demand was rising.

This phenomenon, later on, also appeared once in 2017. When the first hints appeared, there were two views.

1. one side believed that interest rates would not sustain high levels and would soon follow the fall in economic growth and make up for it.

2. the other side believed that money was reacting faster than the price signals from industry and that the increased lending would boost real production and the economy would rebound into overheating in the future.

The result is that interest rates continued to rise in 2013. There were even two "money shortages" in China, meaning that all sectors were borrowing money without any significant improvement in economic growth and new loans were not being made. It was only in 2014 that interest rates and economic growth fell.

So, both sides of the argument are flawed. Looking back, it is true that the real sector generated a lot of demand for loans in 2013, but these loans were mainly taken to pay off debt and replenish cash, and when the debt was taken care of, there was no new demand for loans because of the economic downturn, and interest rates started to go lower.

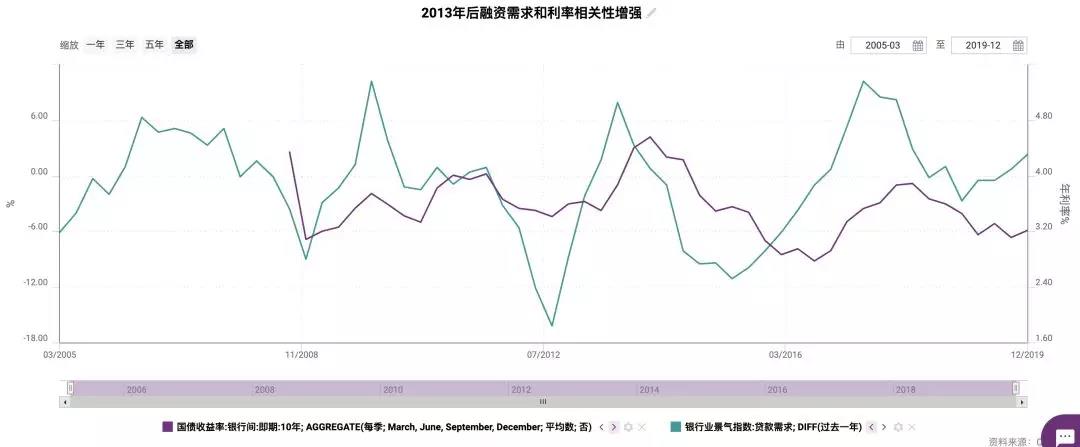

At the root, the economy in 08-12 was too dependent on infrastructure and real estate, which are highly sensitive to funding and are one-off deals that are highly cyclical, making the mismatch between upstream funding and downstream demand. The market has since abandoned its focus on the impact of nominal GDP on interest rates and has instead focused on the impact of loan demand and social financing on interest rates.

So whether you focus on CPI in the early days, or PPI+industrial growth, today it is not as good as focusing on loan demand, and social financing. In the context of domestic investment as the driver of the economy, the credit easing, i.e. the willingness of enterprises to take the initiative to lend, becomes the barometer of the economy and dominates interest rate changes. However, when enterprises no longer take the initiative to lend and begin to cut back on food and clothing, shut down and transfer, the central bank will also lower interest rates early due to political awareness and awareness of the bigger picture, i.e., broad money, to ease the process or hope that enterprises will continue to expand.

In this section we outline how the factors that influence interest rates have evolved over time. Next, we will consider the future of interest rates and how it can guide investments, based on the present.

3. The future of interest rates and investment

For most people in the country, the easily accessible and reliable investments are homes, stocks, and bank wealth management. The relationship between domestic stock prices and housing prices has historically been divided into two phases, with the turning point being the year 2013 mentioned above.

Before 2013, home prices and stock prices were highly correlated, and after 2013, home prices and stock prices were negatively correlated, but of course, the fluctuations of A-shares were greater than those of home prices.

The reason for the same trend before 2013 is intuitive: when the economy is good, corporate earnings are good, especially upstream and downstream companies linked to the real estate cycle, such as building materials, home appliances, greenery and so on. At this time, although interest rates were up, corporate earnings were expanding, so stock prices rose, and residents' incomes increased, which also stimulated demand for housing, and home prices rose.

After 2013, the whole market began to borrow new money to pay off old debts, and real estate is no exception. The rising demand for real estate funds will drive up interest rates. This is a negative for stocks, especially a large number of traditional industries, cyclical industry-oriented A shares, earnings did not improve significantly in those years, and the rise in interest rates is a negative for valuations. From the capital side, when housing prices rise to drive up interest rates, financial returns are also profitable, high risk appetite will go to purchase housing, low risk appetite will go to buy financial products, further dividing the funds of the stock market.

Most of the volatility in A-shares comes from the funding side, which needs to be broken down to look at broad credit. For example, the two bull markets in 06-07 and throughout 2017 were characterized by easy credit, while monetary policy did not become accommodative, but instead tight money allowed interest rates to lift.

The only exception was the 2015 bull market when it was wide money and interest rates continued to go lower, but the economy couldn't take off because it was still tight credit. The reasonable explanation for this is that because the economy continued to slump for several years, many companies with insufficient strength were passively eliminated and left the market, while the continued easing of money on the other side created a situation where there were more water and fewer fish, and the fish that survived enjoyed the stock dividend brought about by the leader and monopoly.

This is similar to Japan and Europe in recent years, although the population is aging, demand is sluggish, economic growth is stagnant, but the continued loose money, superimposed on the continuous extinction of enterprises, but to enhance the competitiveness of large enterprises, optimize the survival space, earnings continue to increase.

Thus, we believe that the future of real estate and A-shares will remain the squeeze effect, based on the forecast of future interest rates and credit: recent bullish A-shares, and that the duration of the bull market in A-shares will exceed expectations.

There are three specific reasons for this.

1. domestic interest rates will slowly decline over the next five to ten years. Local debt replacement, financial support for the real all need a long-term low interest rate environment. But interest rates will not fall as quickly as they did in the past in Europe, the United States and Japan, and will even be lower than the market expects. This is because China still needs to attract foreign investment with appropriate interest rates.

The Internet, smartphones, sharing economy, big data, games, film and television industries that have always been in the boom since at least 2013 and not mentioned before, all of which could not be developed without the wise eye of overseas capital, technology transfer from developed countries and global cooperation in the early stages of their development, and in the future as well.

2. the next five to ten years, the domestic investment and financing expansion will rely more on the securities market. Because of the high interest rates mentioned a little before, even if interest rates are slowly falling, too much reliance on credit will still go back to the route of rising real estate, because bank mortgages need collateral and reliable personal mortgage loans.

And the securities market valuation, must be based on the discounted future value, so the recent reform of the domestic capital market for listing, holding, acquisition, refinancing and other all-round unbundling, the country hopes that A shares in the future to become a paradise for adventurers, hope that these people get and use enough money, hope that the next Tencent, Ali in the A shares grow up;

3. In the next five to ten years, the pattern of low interest, low growth and high financing all over the world will not change, and the finance of cities will become more and more dependent on the consumption of the local population and the taxation of enterprises, and the main body of investment and financing will rely more and more on enterprises, so local governments will put more energy on education, medical, cultural and recreational services, etc. These expenditures used to rely on a single sale of land sales, and in the future, the probability is that they will rely on real estate secondary charges, possibly real estate tax, possibly transaction VAT, etc.

Therefore, we are optimistic about the future of quality stocks in terms of appreciation and dividends, followed by quality residential value-added and low-priced commercial and residential rents, with bank wealth management being the second most important.

We believe that in the next five to ten years, India and Africa will not bring about a global economic recovery and overheating, and the space industry and more efficient energy sources are not mature, so there is no need to worry about the pattern of low interest and low growth being broken. Even if it does break down, it is fortunate, because by the time the economy overheats, assets will have appreciated considerably.

To sum up, we suggest that readers with mortgages can replace them with LPR (loan market quotation rate) in the middle of the year, and encourage to enter A-shares, increase their positions, and actively participate in the upcoming dividends of the sea of new stocks and convertible bonds.

Additional Note: The first draft of this article was completed on March 13, and this number was published on March 24. 10 days of time overseas financial and economic environment has changed dramatically, optimistic people think this crisis is a repeat of 1987, pessimistic people think this crisis is a repeat of 2008 or even 1929. In the context of globalization, no economy can be left alone. Before the epidemic subsides, global stock markets (including A-shares) will fluctuate dramatically, and only cash is safe in a depressed environment. Keep your cash now and prepare for the future when stocks and homes are cheap enough.